ADA Price Prediction: Technical Breakout and Fundamental Catalysts Point to Potential 260% Rally

#ADA

- Technical Breakout Potential: ADA trading above 20-day MA with positive MACD suggests continued upward momentum toward Bollinger upper band resistance

- Fundamental Catalysts: LEIOS development acceleration and potential 2025 ETF approval creating strong positive sentiment

- Price Target Outlook: Historical cycle analysis indicates potential for 260% move toward $1.86 if current support levels hold

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

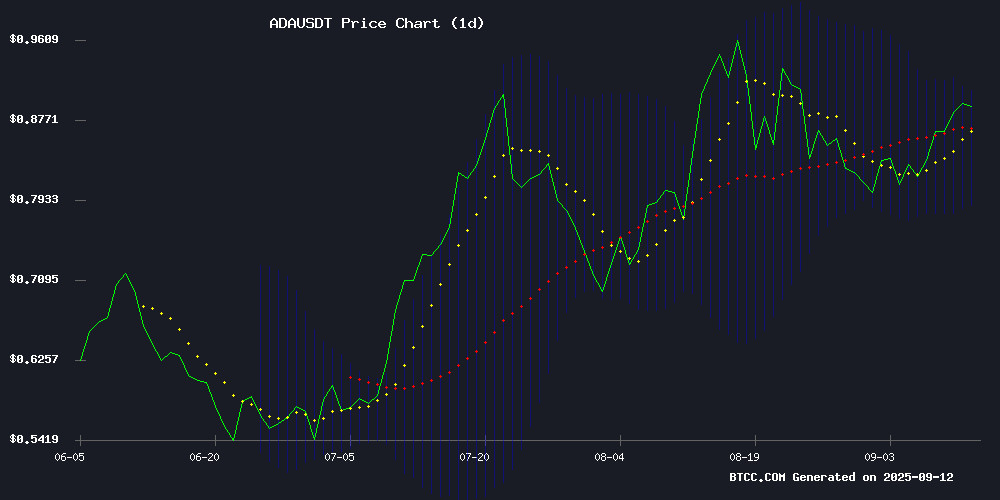

ADA is currently trading at $0.8898, comfortably above its 20-day moving average of $0.84735, indicating sustained bullish momentum. The MACD reading of 0.013997, though positive, shows some divergence from the signal line at 0.027111, suggesting potential consolidation before the next leg up. The price is approaching the upper Bollinger Band at $0.907151, which could act as immediate resistance. According to BTCC financial analyst Ava, 'ADA's position above the 20-day MA with MACD remaining in positive territory supports a cautiously optimistic outlook for near-term price action.'

Market Sentiment: Positive News Flow Supports ADA's Bullish Narrative

Recent developments including the accelerated LEIOS development and potential ETF approval in 2025 are creating strong positive sentiment around Cardano. Charles Hoskinson's stance against regulatory pressure adds to the community's confidence. BTCC financial analyst Ava notes, 'The combination of technical development progress and regulatory defiance creates a powerful narrative that could drive ADA toward the $1.86 target mentioned in recent analysis. However, investors should monitor how these fundamental factors translate into actual adoption and trading volume.'

Factors Influencing ADA's Price

Cardano (ADA) Surges Past $0.89 as LEIOS Development Accelerates

Cardano's ADA climbed 0.51% to $0.89 amid sustained development momentum and speculation about federal blockchain adoption. The rally reflects two key catalysts: the project's "Follow the Sun" 24/7 development model for its LEIOS upgrade, and unconfirmed rumors of founder Charles Hoskinson's discussions with U.S. policymakers about blockchain-based voting systems.

Technical indicators show room for further upside, with ADA's RSI at a neutral 58.23. The accelerated development timeline demonstrates Cardano's commitment to scaling solutions, while the political speculation underscores its growing institutional relevance. Market participants appear to be pricing in both technological progress and potential government adoption pathways.

Cardano’s Charles Hoskinson Mocks SEC in Coinbase Fight: “Gary Can Come In”

Cardano founder Charles Hoskinson has taken a sarcastic jab at former SEC Chair Gary Gensler amid the escalating legal battle between Coinbase and the U.S. Securities and Exchange Commission. The conflict intensified after Coinbase’s Chief Legal Officer, Paul Grewal, revealed the SEC destroyed internal texts from 2022 to 2023—documents critical to ongoing litigation.

Grewal labeled the act a "gross violation of public trust," noting the SEC’s own Inspector General confirmed the destruction. Coinbase is now pushing for expedited discovery, sanctions, and the release of remaining communications. The irony isn’t lost on the crypto community: the regulator known for penalizing firms over record-keeping lapses stands accused of the same.

Hoskinson twisted Gensler’s past rhetoric, quipping, "I’m sure Gary can come in and regis"—a nod to the SEC’s contentious relationship with the industry. The remark underscores broader frustrations over perceived regulatory overreach and hypocrisy.

Cardano ETF Could Trigger Major Price Rally in 2025

Cardano (ADA) is emerging as a standout altcoin in the cryptocurrency market, with analysts forecasting potential returns of up to 200%. The surge in interest coincides with growing anticipation for crypto-friendly regulations and the race for cryptocurrency ETFs.

Open futures positions for ADA have skyrocketed to $2.5 billion, a four-year high, signaling robust institutional and retail demand. This level of activity mirrors previous bullish cycles, suggesting a significant price move may be imminent.

Technical analysis points to a potential breakout, with price targets ranging from $1.86 to a 360% increase. Historical patterns indicate that such rallies often follow periods of consolidation, positioning Cardano for a potential parabolic move.

ADA Price Analysis - September 12, 2025

Cardano (ADA) shows bullish momentum as technical indicators point toward a potential breakout. The digital asset currently faces resistance at $0.91, with analysts targeting $0.96 within the next fortnight.

Market observers note strengthening buying pressure across spot and derivatives markets. A decisive close above the $0.91 level could confirm the upward trajectory, though traders remain cautious of potential profit-taking near psychological resistance levels.

Is Cardano Ready for a 260% Move? ADA Price Targets $1.86 in Repeat Cycle

Cardano (ADA) enters September with bullish momentum, trading near $0.8797 after an 8% weekly gain. The token now holds above all major exponential moving averages—20, 50, 100, and 200-week levels—signaling a potential shift from consolidation to accumulation.

Technical indicators reinforce optimism. Bollinger Bands show price pressing the upper half at $0.9774, historically a precursor to new uptrends. The weekly Relative Strength Index at 55.9 leans bullish, while MACD maintains positive momentum with upward-curving signal lines.

Market analysts highlight a compelling fractal pattern: ADA's previous recoveries saw 260%-360% surges from market lows. A repeat performance could propel the token to $1.86. Immediate resistance looms at $0.95-$0.98, but chart support remains robust after ADA reclaimed its 20-week EMA at $0.7836 in August.

Is ADA a good investment?

Based on current technical indicators and market sentiment, ADA presents a compelling investment opportunity for bullish cryptocurrency investors. The price trading above the 20-day moving average combined with positive MACD momentum suggests underlying strength. Fundamental catalysts including development acceleration and potential ETF approval create additional upside potential.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $0.8898 | Bullish |

| 20-day MA | $0.84735 | Support |

| MACD | 0.013997 | Positive |

| Bollinger Upper | $0.907151 | Resistance |

While the $1.86 target represents significant upside potential, investors should consider appropriate position sizing and risk management given cryptocurrency volatility.